Historically, while remuneration is one of many important factors candidates contemplate when considering their employment, 2022 has shone a spotlight on salaries and seen pay rises becoming almost a non-negotiable when candidates change jobs. We recently surveyed hundreds of finance professionals over the past month and collated the following results, highlighting the major factors contributing to the shift.

QUESTIONS FOR EMPLOYERS:

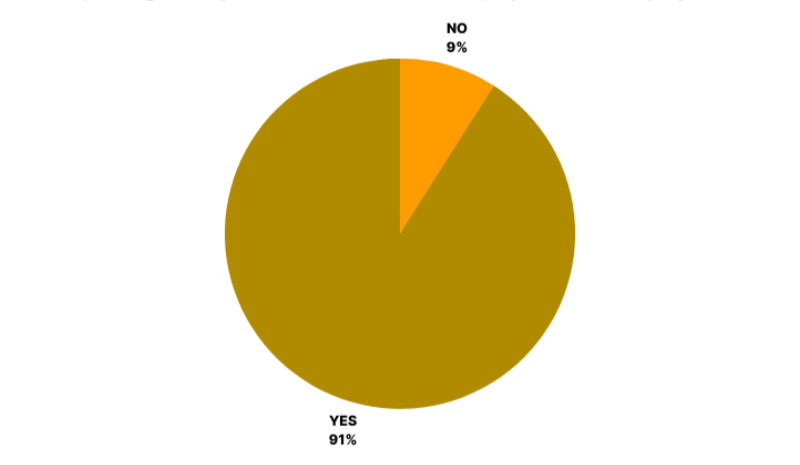

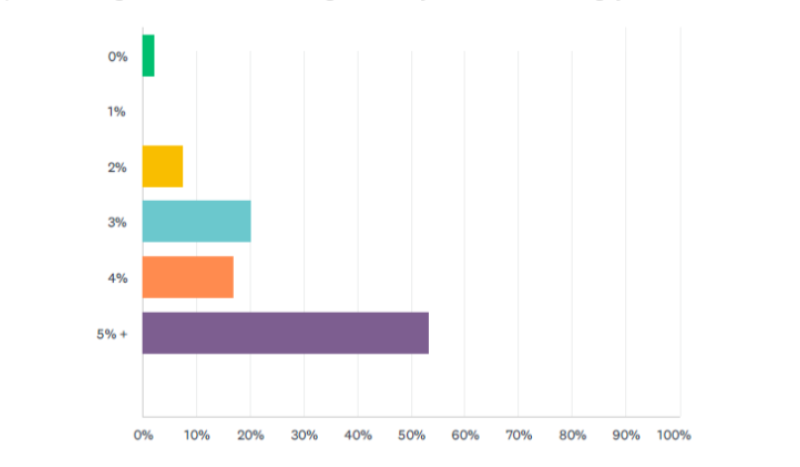

Are you anticipating that your staff will ask for pay rises this pay review cycle?  | | What percentage increase in wages are you forecasting your staff to ask for?  |

QUESTIONS FOR EMPLOYEES:

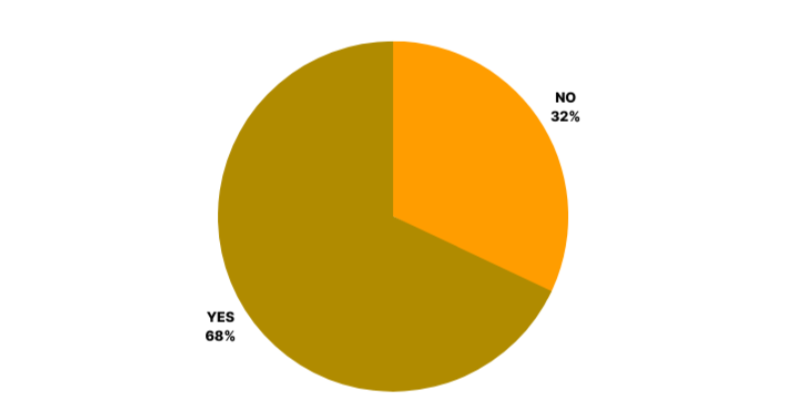

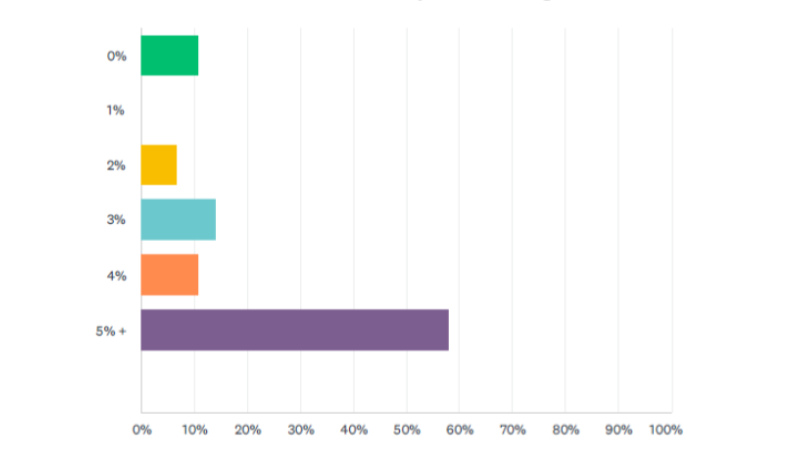

How likely are you to ask for a pay rise?  | |  |

Data collected in June 2022 from the S&C database of approx. over 28,000 clients & candidates**

|

Restructuring (or lack thereof):

When the pandemic hit and uncertainty was high, organisations looked to their finance function to help them navigate through the uncertain headwinds. The recruitment market was tight, but mostly because candidates were averse to the risk of making a move in such a heightened period of uncertainty. With the arrival of JobKeeper and other stimulus measures, companies were able to hold on to their staff. Since then we haven’t yet observed businesses restructuring at the same pace as one generally saw in the decade leading up to the pandemic.

The Endless Musical Chairs Game: |  |

Where to from here?

We expect both migration and restructuring activity to normalise in time, however predicting when and how is much more difficult. Whereas restructuring has historically focused on the senior end of the market, our expectation is that the next round of restructuring activity could well focus on the mid and junior levels, since this is where the tight market has driven the greatest salary growth over the past 18 months.

Click

.png)

.png)